Note: This is a printed version of https://employeehelp.workday.uw.edu/your-pay-taxes/foreign-nationals/glacier. Please visit this page on the ISC website to ensure you're referencing the most current information.

Getting Started in Glacier Tax Compliance

Plan Ahead: Upcoming System Downtime

Glacier Tax Compliance will be unavailable from Monday, December 30 through Friday, January 3 for year-end maintenance. Administrators and employees will not be able to access the system during that time.

On This Page:

- Information for Employees:

- Frequently Asked Questions

- Information for Glacier Administrators:

Overview

Glacier Tax Compliance is a secure, web-based application used by the UW to determine the correct taxation on wages for Foreign National employees. Only Foreign Nationals present in the US should submit information in Glacier Tax Compliance.

Information that a Foreign National must provide in Glacier Tax Compliance includes:

- Visa start and end dates

- Passport page with visa stamp

- Country of residence

- Country of citizenship

- U.S. address

- Foreign address

- Social Security number or ITIN

Based on this information, the UW is then able to determine if the Foreign National:

- Is eligible for any federal withholding tax exemptions via a tax treaty

- Has passed a substantial presence test

- Has become an alien resident for U.S. tax purposes

- Is exempt from FICA taxes (Social Security/Medicare) based on USCIS NRA rules

Failure to complete Glacier Tax Compliance information and provide documents to the Payroll Office may result in inaccurate tax withholding and/or loss of tax treaty exemptions.

Information For Employees

Accessing Glacier Tax Compliance and Assembling Your “Glacier Packet”

-

Enter your information in Glacier Tax Compliance even if you don’t yet have an SSN or ITIN.

Refer to “What should I do if I don’t have an SSN or ITIN?” in the Frequently Asked Questions section of this page for more information.

Once you have been hired to work and entered as an employee in Workday, you will receive an invitation via email to set up your UW Glacier Tax Compliance account:

1. Open the email sent to you by Glacier; the From: address of that message is support@online-tax.net. This is not a spam email. The email will instruct you on how to access Glacier Tax Compliance, submit your information, and provide a temporary login and password. You may change your login and password at this time.

2. Login to Glacier Tax Compliance using the button below.

Login to Glacier Tax Compliance

3. Enter your answers in Glacier Tax Compliance per the instructions in the Glacier Tax Compliance Guide for Employees guide.

4. After completing your Glacier entry, print (single-sided, please!) all of the documents that Glacier generates, including the Glacier Tax Summary Report.

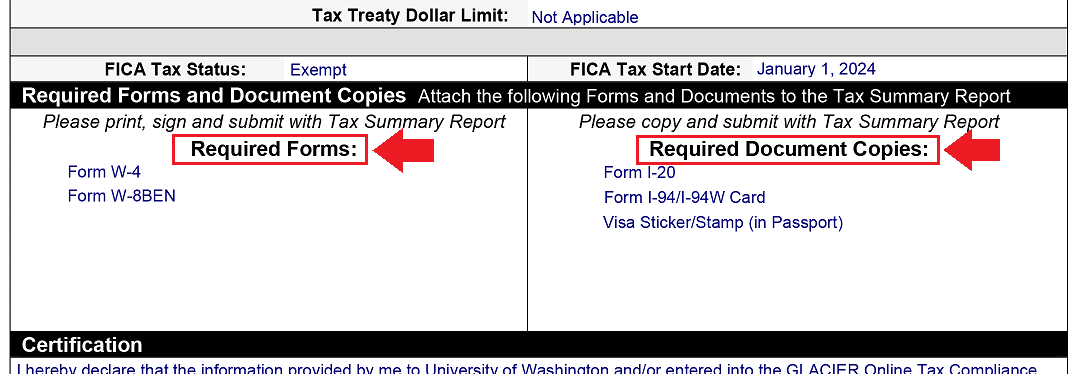

5. Locate the Required Forms and Document Copies section of your Glacier Tax Summary Report. Prepare the documents listed in the Required Forms and Required Document Copies boxes, highlighted in the below image; note that the documents listed on your Report may differ from those shown here.

6. If applicable, gather the following additional documentation:

- If you are working with an Employment Authorization Card, please include a copy of your Employment Authorization Card. (Even though this is not listed under Required Document Copies on the Tax Summary Report, it is still required.)

- If your SSN was recently issued to you or has not yet been entered into Workday, please submit a copy of your Social Security card along with your Glacier paperwork. You will also need to contact the UW Registrar’s Office at registra@uw.edu so they can update your student record; DO NOT include your SSN in your email.

7. Verify that you have signed and dated all documents listed in the Required Forms box. Be sure to use a handwritten signature – electronic signatures are not accepted.

8. Sign and date the Glacier Tax Summary Report.

9. Mail the paperwork from steps 4-8 (your “Glacier packet”) to the following address (you may use UW campus mail or any US mailing service convenient for you):

Payroll Office

UW Tower, Floor O-2

4333 Brooklyn Avenue NE

Box 359555

Seattle, WA 98195

Attn: Glacier Administrator

Note that your Glacier packet must be mailed – electronic submission of your paperwork is not permitted, owing to the confidential information it contains.

Tax Treaties – Eligibility, Paperwork, and Renewal

A tax treaty is an agreement negotiated between the United States and a foreign country to reduce double taxation on residents of the foreign country. The information you provide in Glacier Tax Compliance will help the Payroll Office determine if you are eligible for any tax treaties that will exempt you from having to pay federal withholding taxes.

- Lists of current wage tax treaties and Scholarship/Fellowship tax treaties are available in IRS Publication 901. Carefully review the eligibility criteria specified, including in footnotes.

- Refer to IRS Publication 519 for information regarding taxes for nonresident aliens.

- Information on which countries have tax treaty agreements and the tax treaty details are available on the IRS website.

Generating your tax treaty eligibility paperwork

Glacier Tax Compliance generates the tax treaty-related paperwork that you need to include in your Glacier packet:

- IRS Form 8233 – Glacier Tax Compliance will generate Form 8233 and a Form 8233 attachment that is a verification of your tax treaty eligibility. Both forms must be signed and dated, if you have wage payments that have been determined to be exempt from federal withholding tax.

- IRS Form W-8BEN – Glacier Tax Compliance will generate this form if you are determined to be eligible for a Scholarship/Fellowship tax treaty.

There are several requirements to be eligible for a tax treaty benefit for federal withholding taxes. If Glacier Tax Compliance determines that you are not eligible for a tax treaty, no tax treaty-related forms will be generated. However, you can still claim the exemption as part of the personal tax return you file with the IRS.

-

Tax treaty eligibility paperwork must be renewed.

For your federal taxation to continue to be appropriately reduced:

⇒ IRS Form 8233 must be renewed every calendar year.

⇒ IRS Form W-8BEN must be renewed every three calendar years.

Every November, foreign nationals who might again qualify for a federal withholding tax exemption on their wages must renew their Form 8233 (and the required attachment) for the upcoming year and send that paperwork to the Payroll Office for processing. Note that, to be eligible to renew your Form 8233, you must:

- Have a social security number or ITIN entered in Glacier Tax Compliance, and

- Be a nonresident alien for tax purposes at the beginning of the new calendar year, and

- Have work authorization status that has not expired, or will not expire before the end of the current year.

Glacier will notify you via email when the renewal period has opened. The email you receive will provide you with step-by-step instructions for renewing your paperwork via Glacier Tax Compliance.

To ensure processing in time for your first paycheck in January, your paperwork must be:

- printed single-sided, and

- signed where indicated, including the Tax Summary Report Update cover page, and

- received by the Payroll Office by the deadline indicated in the renewal email. Refer to step 9 of the Accessing Glacier Tax Compliance and Assembling Your “Glacier Packet” section above for the mailing address.

Frequently Asked Questions

Getting Help

Using Glacier Tax Compliance

Tax Treaties

Taxes

Information For Administrators

Responsibilities

Departments that enter Foreign National employees (staff, faculty, students) into Workday should designate a Glacier Administrator. The Glacier Administrator is responsible for:

- Adding new Foreign National employees* to Glacier Tax Compliance

- Monitoring whether a Foreign National employee has submitted their required information to the Payroll Office

*Foreign Nationals that will not be receiving payments through Workday (i.e. Contingent Workers, Unpaid Academics, individuals with 100% PDR compensation) do not need to complete Glacier Tax Compliance.

Obtaining Administrator Access to Glacier Tax Compliance

Due to the sensitive information in Glacier Tax Compliance, the Payroll Office provides access to one Administrator per department; exceptions are made on a case-by-case basis.

Training is required before administrator access will be provided. To arrange a 30-45 minute training session, contact the Payroll Office with the subject “Glacier Admin Training Request.” Please include your unit/department name, and whether you will be replacing your unit’s current Glacier Tax Compliance Administrator.

Using Glacier Tax Compliance

After completing the required training, Glacier Administrators can refer to the Glacier Tax Compliance Guide for Administrators for step-by-step instructions on adding employees and determining the status of their Glacier paperwork.